111 | Add to Reading ListSource URL: www.neiinvestments.comLanguage: English - Date: 2018-03-02 13:11:54

|

|---|

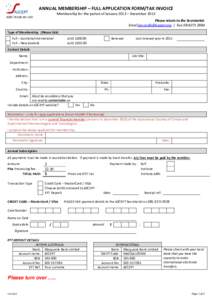

112 | Add to Reading ListSource URL: newtoncad.orgLanguage: English - Date: 2015-04-01 11:21:08

|

|---|

113 | Add to Reading ListSource URL: www.upc-online.orgLanguage: English - Date: 2009-07-10 16:21:17

|

|---|

114 | Add to Reading ListSource URL: d346eec38baehp.cloudfront.netLanguage: English |

|---|

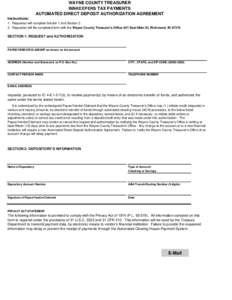

115 | Add to Reading ListSource URL: www.co.wayne.in.usLanguage: English - Date: 2017-01-11 09:54:33

|

|---|

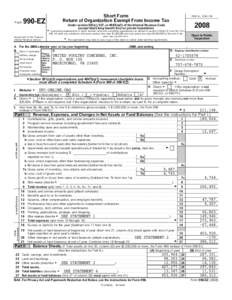

116 | Add to Reading ListSource URL: www.unclefed.comLanguage: English - Date: 2009-01-12 09:09:19

|

|---|

117 | Add to Reading ListSource URL: www.girlsontherun.orgLanguage: English - Date: 2017-06-26 09:27:55

|

|---|

118 | Add to Reading ListSource URL: files.montgomerycountync.gethifi.comLanguage: English - Date: 2016-05-02 11:36:12

|

|---|

119 | Add to Reading ListSource URL: www.apache.orgLanguage: English - Date: 2018-06-01 11:47:15

|

|---|

120 | Add to Reading ListSource URL: www.irs.govLanguage: English - Date: 2018-01-22 22:00:17

|

|---|